At the recently held BBMP – Work Orders, Budgets and Processes Datajam, a group of citizen volunteers analysed the data available in the public domain, here are their observations and suggestions on BBMP’s cess collection.

To:

Sri. Nagaraj Sherigar

BBMP Additional Commissioner (Finance)

Dear Sir,

We are a group of citizen volunteers who would like to share our observations and suggestions on BBMP’s cess collection.

Observations:

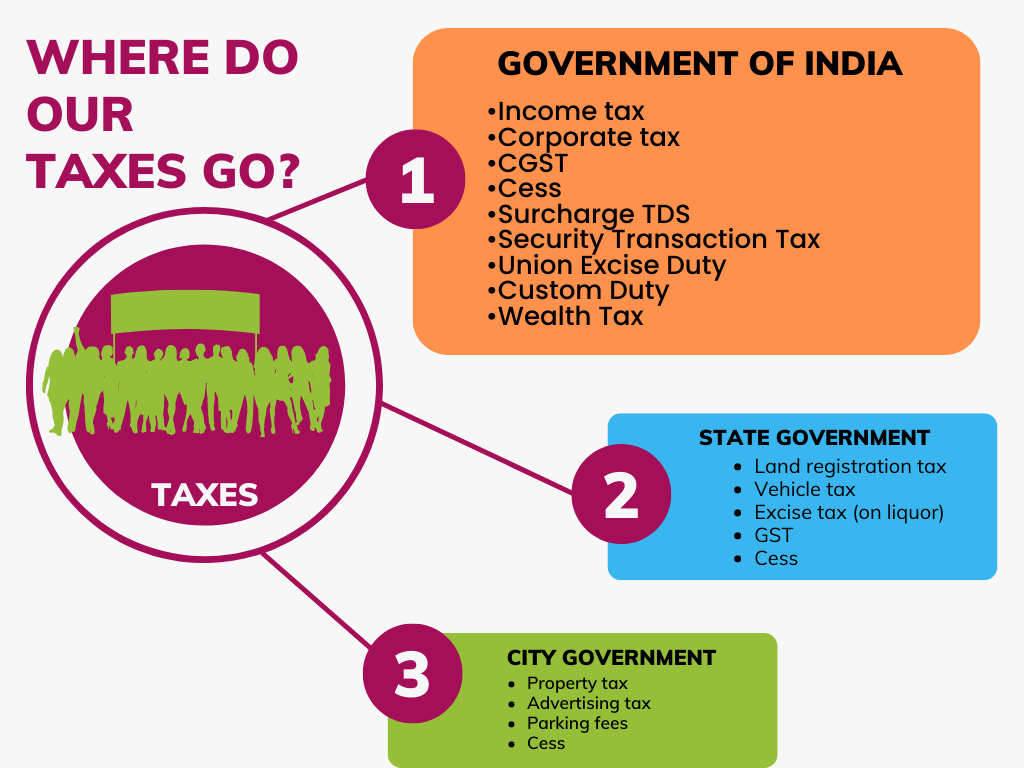

We attempted to find out how much cess and surcharge was being collected each year by BBMP based on the agency’s cess receipts and where it was spent. The team found that although typically cess forms approximately 26.6% of property tax collected, in 2022-23, cess was 45.73% of the property tax collected. However, it was not clear if this was due to changes in cess rates or arrears from the previous year.

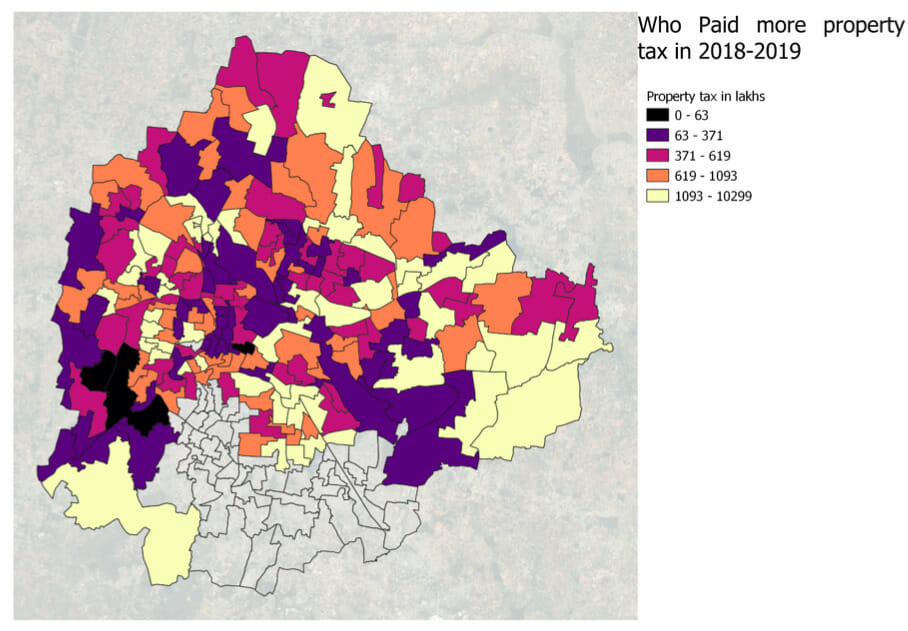

From the available data, we found at least 20 categories of cess collected by the BBMP, but the differences between these cess categories (for e.g., garbage cess and solid waste management cess) is not clear to the public. Moreover, the data does not provide clarity on how the cess was spent and the reasons for the expenditure. For instance, according to available data, the Nirashrithara Parihara Kendras for the homeless and destitute are maintained with only 3% of the beggary cess. However, municipal bodies are eligible to keep 10% of the beggary cess. It is unclear where the remaining 7% of the beggary cess collected by the BBMP is spent. We also found that the latest ward-wise property tax data has not been made publicly available.

Read more: How does BBMP compute Property Tax

Suggestions:

- Define all cess categories clearly

- Publish clear data on BBMP’s cess collection annually

- Provide clear receipts and details on where cess is spent

- Provide ward wise data on property tax again

- Cess is a form of public fund. All data related to it should be publicly available

Read more: BBMP’s plan to fix property tax gaps and loopholes

About us:

We are volunteers who participated in a recent OpenCity data jam – civic solutions workshop. The datajam was organised by OpenCity , a civic tech project that helps make public data on cities accessible to all. Our goal is to enable citizens and civic groups to have a shared understanding of their city’s issues and use data as a basis for co-creating solutions. At the event on July 15th, we looked at BBMP work orders, budgets and processes.

More about the event can be found here.

Report compiled by Bhanu Sridharan

As long as revenue sites are there,complete city is too far..

Bring akrama sakrama all city basic facilities can be given to all the people..